The initial priority issue for FA will be educating Canadians about that enormous number shown in our ATM: the net transfer Albertans make, via federal taxes and levies, to the federal government, for the benefit of Canadians in other parts of Canada.

Despite the ongoing economic slowdown since 2015, in 2018 (the most recent year StatsCan has calculated) Albertans sent over $17 billion to Ottawa that was then disbursed to other provinces. $17 billion is almost as much as Albertans spend on their entire health care system, and twice as much as our large provincial deficits in recent years. In 2014, with a stronger economy, it was a staggering $27 billion that Albertans sent to Ottawa to be spent elsewhere.

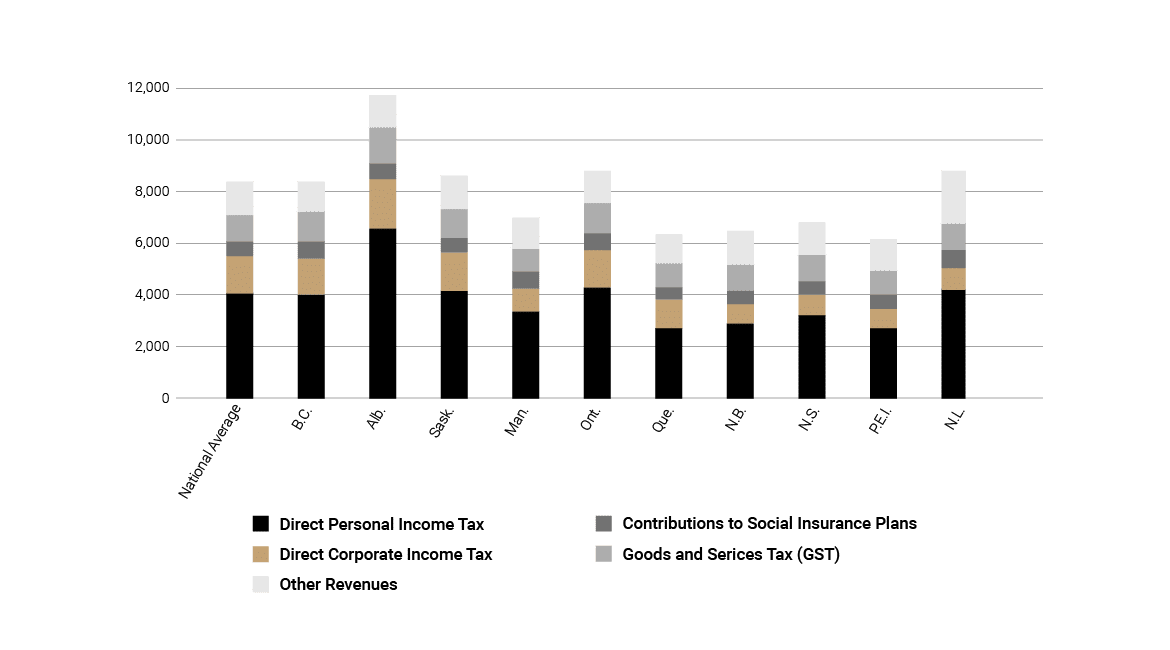

Where does this money come from? As the 2017 chart below shows, it is largely federal taxes and EI premiums.

Albertans have been contributing about $47 billion a year to Ottawa in taxes and EI premiums (as shown in the net transfers from 2000-2018 table you can find in Further Data at the bottom of this section). When you consider that this number is roughly equivalent to the operating expense of the entire provincial government, it provides some perspective on its scale. When compared to its population (11.6% of Canada), the 16.66% from Alberta in 2018 of all internal tax revenues is quite remarkable: even in a downturn, Albertans have been contributing nearly 50% more than they would have based on an even per capita contribution level.

We chose to exclude net transfers from CPP, but it would add roughly another $2.7 billion to the annual totals over the last decade, and over $40 billion from 2000-2019 due to the proportion of Albertans who have been working full-time over that period.

It is true that this overall net transfer is in principle a result of Albertans having higher productivity and wages, and a higher proportion of employed people due to a younger population, but the size of the transfer is ultimately due to the extent to which ‘scope creep’ has expanded the federal purse into provincial jurisdiction.

Put simply, the productivity of Albertans determines the proportion of the pie they contribute, but the amount transferred depends on how big the federal government has made that pie and how it decides to portion it out..

We should note that Albertans’ incomes are not something to apologize for, or to target. Alberta’s productivity and employment rates have certainly been enhanced by its resources, but without decades of elected leaders promoting policies that encouraged investment, and without the nation-leading long hours of hard work put in by individual Albertans, those resources would sit undeveloped – as they have over time in various other provinces.

In addition, a young, productive, and growing population generates its own pressures, such as significant strains on school capacity and other infrastructure, as well as overall inflation and other costs. Alberta has faced such pressures without any unique consideration from federal governments of any political stripe. High productivity areas in a company or in an economy normally invite higher levels of reinvestment; for example, a rational policy would be to leave more money in Alberta so Alberta can make extra infrastructure investments to facilitate ongoing productive activity and wealth creation.

Unfortunately, in Canada’s current federal system, Alberta’s higher productivity is something that is systematically and exclusively used to fund programs that favour other regions of Canada.

Where does this money go? Some have the impression that transfers like Equalization somehow come from our provincial government and are sent to other provinces. The reality is, however, that our various federal taxes go to general revenues, and from there all programs are funded.

So when these relatively high dollar amounts Albertans pay go toward core federal expenses such as our military, border agency, and financial regulations, there is no cause for complaint in principle. It has been a very long time, though, since the federal government limited itself to its core functions as originally envisaged in the Constitution. Whenever the federal government starts spending money in areas it doesn’t need to, including areas constitutionally mandated as provincial jurisdiction, Albertans have been disproportionately footing these added bills.

Under the Constitution of Canada there are certain enumerated areas of jurisdiction where the federal government has constitutional responsibility. There are other areas where the provinces have jurisdiction. The primary areas of social spending – such as health, education, universities, children’s care, social supports – are under provincial jurisdiction. Over time, the federal government has become increasingly involved in areas of provincial jurisdiction by providing significant transfers such as the $40 billion Canada Health Transfer (CHT) to provinces from the federal purse.

There is constitutional justification for some federal involvement in social services. Section 36(2) declares a commitment “to the principle of making equalization payments to ensure that provincial governments have sufficient revenues to provide reasonably comparable levels of public services at reasonably comparable levels of taxation.” As we explain in our Equalization section, however, the federal government is far exceeding its minimal and vague requirements under section 36(2) the Constitution.

The federal government has much broader constitutional taxation powers than the provinces, and has used these powers to raise funds (disproportionately from Alberta as noted) to then strategically spend in areas of provincial jurisdiction. The federal government’s “scope creep” has also expanded significantly not only in social services but in such areas as infrastructure and environment. The environment is an area of shared jurisdiction, but the regulation of natural resources remains a provincial responsibility that is regularly infringed upon by federal environmental initiatives.

This “scope creep” by Ottawa has been used to justify various forms of interference in provincial economies, including increased levels of taxation by the federal government.

For decades, every decision by a federal government to increase spending has affected Albertans disproportionately given how much of the share they have paid.

The Government of Canada provides significant financial support to provincial and territorial governments on an ongoing basis to assist them in the provision of programs and services in areas that are traditionally provincial jurisdiction. There are four main transfer programs: the $40 billion CHT noted above, $15 billion for the Canada Social Transfer (CST), $20 billion for Equalization and the $4 billion Territorial Formula Financing (TFF).

The CHT and CST are federal transfers which support specific policy areas such as health care, post-secondary education, social assistance, and early childhood development. Since 2014 these transfers have been distributed on a per capita basis so Alberta got about $6.3 billion from the two combined in 2019-20. Albertans’ proportional contribution to tax revenues, however, means they contributed about $9.2 billion to the $55 billion total, and only got the $6.3 million back. In other words, Albertans paid nearly $3 billion to Ottawa through these programs that then went directly to other provincial governments to help pay for their constitutionally mandated responsibilities. This is a subtle but very significant structural redistribution of wealth, particularly as Albertans grapple with stretching their own health and social services dollars further.

The Equalization and TFF programs provide unconditional transfers to the ‘have not’ provinces and all three territories. TFF provides territorial governments with funding to support public services, in recognition of the higher cost of providing programs and services in the north. Equalization, which will surpass $20 billion in 2020, will be analyzed much more fully in our next section; for now, we note that Albertans’ 16.6% proportional contribution to that $20 billion is roughly $3.3 billion – larger, but only slightly, than our net contribution to CHT and CST combined.

Together, that means about $6.5 billion of the federal taxes paid by Albertans in 2018 was sent by Ottawa directly to other provincial governments to pay for their provincially mandated areas of responsibility (over $7 billion if you include the over $600 million going to TFF). Keeping in mind how much Albertans have struggled during this downturn, the fact Ottawa sent more of their tax dollars via these programs to other provincial governments than the $6.391 billion Alberta got back through them makes the lack of fiscal fairness in Canada right now readily apparent.

In the next section we will take a long look at Equalization, before rounding out the picture by looking at net contributions Albertans make in other programs like EI, CPP, infrastructure, and federal employment. It is important to establish, however, that the $20 billion equalization program, and the roughly $3.3 billion Albertans put into it, is only one part of the systemic fiscal fairness problem Albertans are struggling with.

Analytical work originally done by Fred McDougall (Fred is a Vice President of Fairness Alberta) and later by others, including Robert Mansell of the University of Calgary, focused on the broader net fiscal contributions of the provinces. This goes well beyond the impact of equalization transfers and measures the total funds flowing from provinces to the Federal Government and the funds flowing back to the provinces. This is based on Statistics Canada table 36-10-0450-01 (formerly CANSIM 384-0047). This data is shown below by province in both gross dollars and per capita.

Millions of Dollars | ||||||||

|---|---|---|---|---|---|---|---|---|

Revenue | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |

Personal income Tax | 21,295 | 23,629 | 25,737 | 26,992 | 22,707 | 24,444 | 25,737 | |

Corporate income Tax | 7,839 | 9,066 | 10,041 | 8,697 | 7,296 | 6,376 | 6,531 | |

Goods and services tax | 4,503 | 4,808 | 5,169 | 5,250 | 5,014 | 5,330 | 5,547 | |

EI Contributions | 2,769 | 3,273 | 3,449 | 3,415 | 3,256 | 2,799 | 2,934 | |

Other Revenue¹ | 4,969 | 5,353 | 5,593 | 5,352 | 5,028 | 5,480 | 5,997 | |

Total Revenue | 41,375 | 46,129 | 49,989 | 49,706 | 43,301 | 44,429 | 46,728 | |

Expenditure | ||||||||

Health and social transfers | 3,855 | 4,143 | 4,733 | 5,273 | 5,551 | 5,860 | 6,077 | |

Final expenditure on goods and services | 4,637 | 4,617 | 4,641 | 4,604 | 4,721 | 5,132 | 5,187 | |

Old age security | 3,150 | 3,277 | 3,434 | 3,621 | 3,823 | 4,106 | 4,407 | |

EI benefits | 1,281 | 1,334 | 1,471 | 2,094 | 3,079 | 2,760 | 2,278 | |

Interest on public debt | 2,999 | 3,036 | 2,857 | 2,720 | 2,553 | 2,488 | 2,748 | |

Other expenditure² | 6,218 | 6,204 | 5,797 | 6,638 | 7,615 | 8,824 | 8,856 | |

Total Expenditure | 22,140 | 22,611 | 22,933 | 24,950 | 27,342 | 29,170 | 29,553 | |

Net Contribution (Revenue less Expenditure) | 19,235 | 23,518 | 27,056 | 24,756 | 15,959 | 15,259 | 17,175 | |

Net Contributions ($ per capita) | 4,964 | 5,908 | 6,625 | 5,973 | 3,803 | 3,596 | 3,994 | |

¹ Other revenue – withholding taxes, fuel taxes, excise duties, etc.

² Other expenditure – child benefits, interest on the debt, transfers to aboriginal governments, etc.

Year | Federal Revenue | Federal Expenditure | Net Contribution | 2000 | 22.1 | 14.3 | 7.8 |

|---|---|---|---|

2001

| 22.7 | 14.6 | 8.1 |

2002 | 22.7 | 14.4 | 8.3 |

2003 | 23.6 | 15.8 | 7.8 |

2004 | 26.0 | 16.4 | 9.6 |

2005 | 30.0 | 17.0 | 13.0 |

2006 | 34.6 | 16.8 | 17.8 |

2007 | 38.3 | 17.4 | 20.9 |

2008 | 39.7 | 18.7 | 21.0 |

2009 | 36.0 | 20.0 | 16.0 |

2010 | 36.0 | 20.4 | 15.5 |

2011 | 39.6 | 20.6 | 18.9 |

2012 | 41.4 | 22.1 | 19.3 |

2013 | 46.1 | 22.6 | 23.5 |

2014 | 50.0 | 22.9 | 27.1 |

2015 | 49.7 | 24.9 | 24.8 |

2016 | 43.3 | 27.3 | 16.0 |

2017 | 43.9

| 29.3 | 14.6

|

2018 | 47.2 | 29.8 | 17.4 |

Totals | 629.9 | 385.0 | 307.9 |

Total 19 Year Average/Year | 36.47 | 20.26 | 16.2 |

Last 5 Years Average/Year | 46.82 | 26.78 | 20.08 |

Source: Statistics Canada.